Amended Tax Return Online For Free 2020

The OnLine Taxes provides Amended Return Services such as. To do so you must have e-filed your original 2019 or 2020 return.

Amended Return Status Where S My Amended Tax Return

Choose At a glance from the left-hand menu.

Amended tax return online for free 2020. In order to make changes corrections or add information to an income tax return that has been filed and accepted by the IRS or state tax agency you must file a tax amendment to correct your returns. To qualify the larger refund or smaller tax liability must not be due to differences in data supplied by you your choice not to claim a deduction or credit positions taken on your return. How to find my.

Paper filing is still an option for Form 1040-X. Taxpayers can now file amended returns electronically. If youre using our free program youll need to upgrade to a different program if you want to e-file.

Go into the tax return make the corrections and file it again. 2020 Amended - Original Return was not filed with OLT. For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021.

For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021. Individual Income Tax Return for this year and up to three prior years. For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021.

For more details see our August 2020 news release on this topic. If you did not file your original return using FreeTaxUSA you can still prepare your amended return through our website by entering your tax information again. Then you can select the option to amend your return.

Processing it can take up to 16 weeks. Your amended return will take up to 3 weeks after you mailed it to show up on our system. See the additional options below eg.

Terms and conditions may vary and are subject to change without notice. Previous tax years state taxes Form 1040-X etc. OnLine Taxes Amended Return Services.

Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023. For tax years 2019 and 2020 if the original return was e-filed in most cases you can e-file the amended return as well for Federal. If you filed your 2020 return with our online program you can prepare an amended return with us.

Once youve been notified by the IRS that they have received and accepted your original return for 2020 then you can amend your tax return online. You still have the option to submit a paper version of the Form 1040-X and should follow the instructions for. If you find an error in the HR Block online tax program that entitles you to a larger refund or smaller liability we will refund the fees you paid us to use our program to prepare that return and you may use our program to amend your return at no additional charge.

After you have made online changes to your tax return keep all your receipts and supporting. For the initial phase only tax year 2019 Forms 1040 and 1040-SR returns can be amended electronically. With HR Block you can file an amended tax return online.

It makes submitting an amended return easier and it allows our employees to process it in a more efficient way said Ken Corbin the IRS Wage and Investment commissioner and head of the division responsible for processing these returns. You are however free to. Estimate your 2020 tax refund.

Choose Tax return options. IRS Tax Tip 2020-114 September 3 2020 The IRS will correct common errors during processing. Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023.

After 11302021 TurboTax Live Full Service customers will be able to amend their 2020 tax return themselves using the Easy Online. Terms and conditions may vary and are subject to change without notice. IRS has advised people due for refunds from their initial returns to wait until they get the refund before handing in Form 1040X to claim for extra refunds.

Only tax year 2019 Forms 1040 and 1040-SR returns can be amended electronically. Answer a few simple questions about your life income and expenses and our free tax refund calculator will give you an idea if you should expect a refund and how muchor if the opposite is true and youll owe the IRS when you file in 2021. Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023.

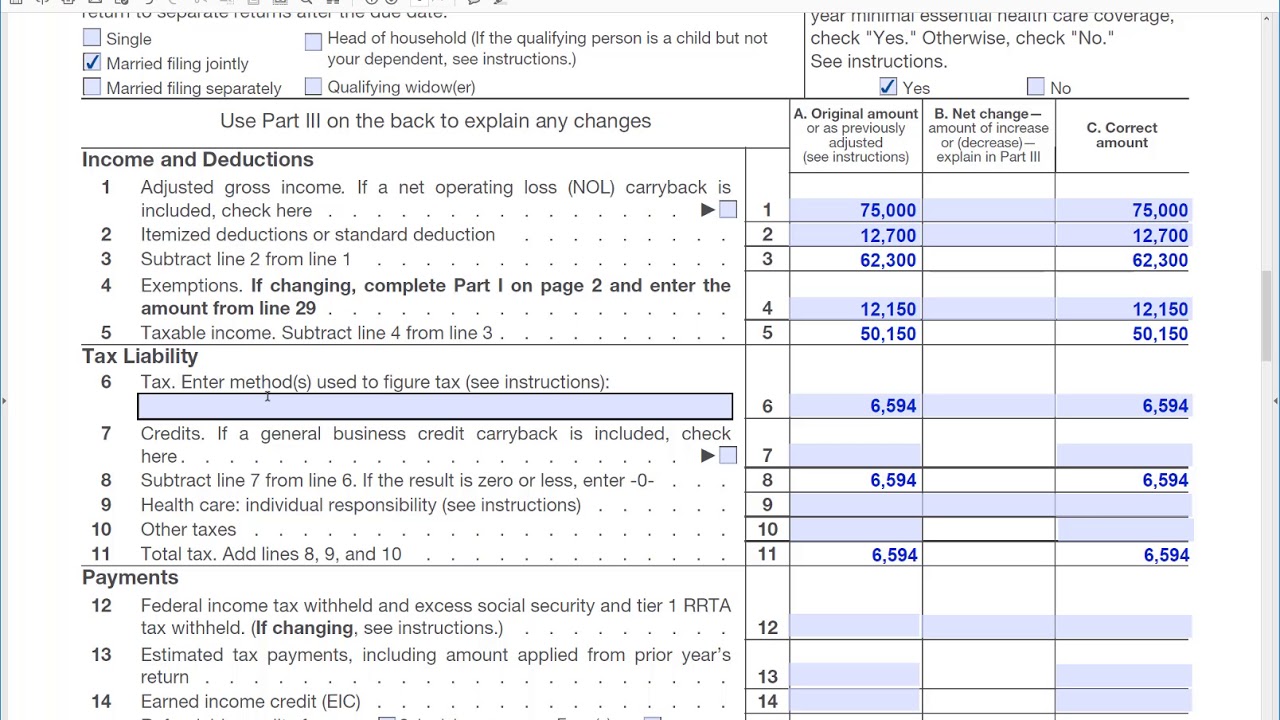

Here are some tips for anyone who discovered they made a mistake or forgot to include something on their tax return. Terms and conditions may vary and are subject to change without notice. File Form 1040-X to do the following.

After 11302021 TurboTax Live Full Service customers will be able to amend their 2020 tax return themselves using the Easy Online Amend. INCOME TAX CALCULATOREstimate your 2020 tax refund. After 11302021 TurboTax Live Full Service customers will be able to amend their 2020 tax return themselves using the Easy Online.

An EFILE service provider can change your T1 return online for the 2020 2019 2018 and 2017 tax years with EFILE certified software. OnLine Taxes will help you file amended returns for both your federal and state income tax returns if needed. It also takes 12 weeks to complete processing requests for amended returns.

Check the status of your Form 1040-X Amended US. Please see IR-2020-107 and IR-2020-182 for additional information. There are situations where you cannot use ReFILE.

To find out about the exceptions go to What does ReFILE exclude. 2020 Amended - Original Return was filed with OLT. For more information about this service go to ReFILE.

Additional improvements are planned for the. However there are certain situations in which a taxpayer may need to file an amended return to make a correction. You can now file Form 1040-X electronically with tax filing software to amend 2019 or 2020 Forms 1040 and 1040-SR.

During that time you can also prepare a 2020 Tax Amendment and soon you will also be able to e-File the Form 1040-X. Be sure that your federal return entered on our website matches your original return that you e-filed or mailed. If you have to mail print all forms listed and mail them to the IRS along with any income statements if income was changed in your amended return or supporting documents for changes in credits.

Choose the tax year for the return you want to amend.

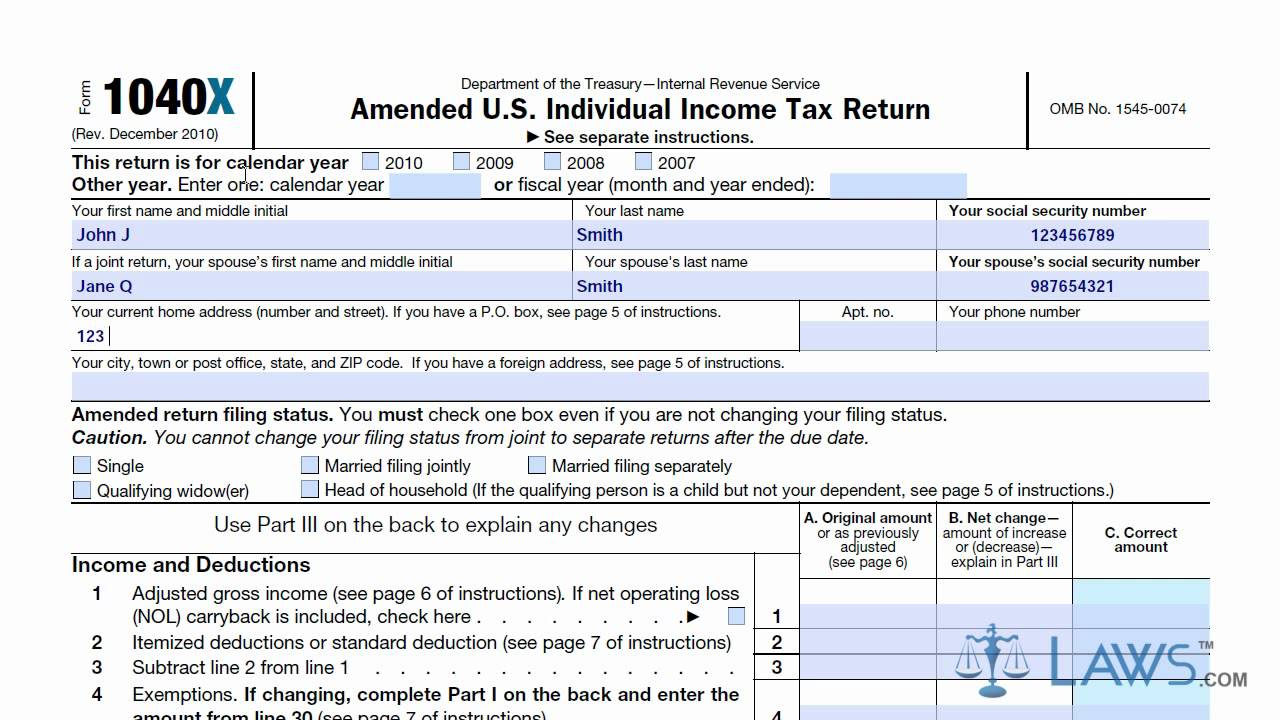

How To Fill Out Form 1040x Amended Tax Return Youtube

Ask The Tax Whiz Can I Amend My Income Tax Return

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

How To Amend An Incorrect Tax Return You Already Filed

Where S My Amended Return 7 Points One Must Know Https Www Irstaxapp Com Wheres My Amended Return How To Find Out Income Tax Return Business Tax

How To Fill Out A Us 1040x Tax Return 12 Steps With Pictures

How To File An Amended Tax Return Credit Karma Tax

How To Amend An Incorrect Tax Return You Already Filed

How Long Does An Amended Tax Refund Take To Be Issued Lovetoknow

Amended Tax Return How To Adjust An Already Lodged Return

How To Amend A Tax Return Online Tax Return Irs Tax Forms Tax

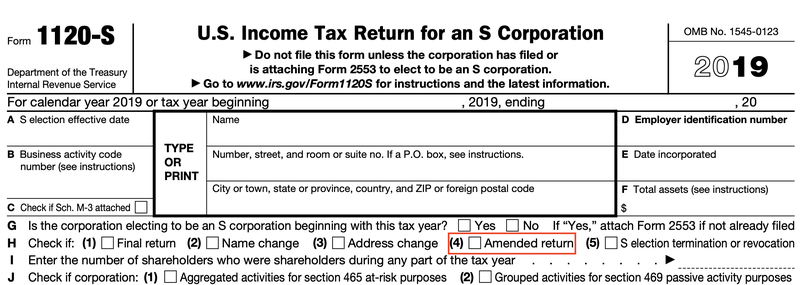

How To File An Amended 1120 S With The Irs The Blueprint

How To Amend Your Tax Return With Sprintax Youtube

How To Amend An Incorrect Tax Return You Already Filed

When Should You Amend Your Tax Return The Turbotax Blog

2020 1040x Form And Instructions 1040 X

How To Fill Out A Us 1040x Tax Return 12 Steps With Pictures

Learn How To Fill The Form 1040x Amended U S Individual Income Tax Return Youtube

Post a Comment for "Amended Tax Return Online For Free 2020"